| DONA D. YOUNG (she/her/hers) Non-Executive Chair Age: 70 Director since: 2001 | ► |

| PROFESSIONAL EXPERIENCE | | Chairman, | | Independent executive and board consultant | | | | The Phoenix Companies, Inc. (insurance and asset management company) | | | | ► | Chair, President and Chief Executive Officer, April 2003 to April 2009 |

OTHER BOARD SERVICE

| ► | | OTHER BOARD SERVICE | | Chairman | | ► | Director, Chair of the Supervisory Board RiskCompensation and Human Resource Committee, member of Nomination and Governance Committee, and member of the Supervisory Board Nomination and GovernanceRisk Committee, Aegon N.V.Ltd. (insurance, pension, and asset management company) |

| | | ► | Director, Vice Chair of Audit Committee, and member of the Nominating and Governance Committee and Compensation and Workforce committees,Committee, USAA (United Services Automobile Association) |

| | | ► | Director and member of Executive Committee, Spahn & Rose Lumber Co. | | | | ► | Director, Chair of the Compensation Committee, and Chairmember of the Nominating and Governance Committee, NACD |

| ► | Board Member, Spahn & Rose Lumber Co. |

| ► | Director and member of the Audit and Governance committees, Save the Children Association and Save the Children International (non-profit organizations), 2016 to 2023 |

| | | ► | Director and member of the Audit Committee, Save the Children U.S. (non-profit organization), 2012 to 2023 |

| | | ► | Trustee, Saint James School in Saint James, Maryland |

REASONS FOR NOMINATION

Ms. Young has significant governance, legal, mergers and acquisitions, risk management, and financial experience given her prior service as a public company General Counsel, and later CEO, which are relevant in her role as Lead Independent Director. The education and experience Ms. Young acquired through her board service at Save the Children are useful in her oversight of the Company’s human rights efforts. In addition, she was named by the Financial Times’ Outstanding Directors Exchange as a member of its Outstanding Directors class of 2021, the NACD Directorship 100 for 2015, and a NACD Board Leadership Fellow since 2013. She is NACD Directorship Certified™, completed the NACD Cyber-Risk Oversight Program, earned a CERT Certificate in Cybersecurity Oversight conferred by Carnegie Mellon University, and was a 2012 Advanced Leadership Fellow at Harvard University.

COMMITTEES | RELEVANT SKILLS | A E R |  |

18

| Foot Locker, Inc. | |

PROPOSAL 1: ELECTION OF DIRECTORS

| VIRGINIA C. DROSOS | | | Independent Director | Age: 59 | Director since: 2022

REASONS FOR NOMINATION | | | | | Ms. Young has significant governance, corporate development, risk management, leadership development, and financial experience given her prior service as a General Counsel, and later as a public company CEO, which are relevant in her role as Non-Executive Chair, as well as a member of the Audit Committee and NCR Committee. The experience Ms. Young has acquired through her board service at Save the Children is useful in her oversight of the Company’s human rights efforts. Ms. Young has received numerous awards and distinctions throughout her career, including being named one of four individuals identified by the Financial Times’s Outstanding Directors Exchange as a member of its Outstanding Directors Class of 2021 and the NACD Directorship 100 for 2015. She has served as an NACD Board Leadership Fellow since 2013, and was a 2012 Advanced Leadership Fellow at Harvard University. She obtained the CERT Certificate in Cybersecurity Oversight through the Software Engineering Institute at Carnegie Mellon University and NACD. She also received the NACD Director Certified designation. |

| COMMITTEES | RELEVANT SKILLS | | |

PROFESSIONAL EXPERIENCE

15 | Foot Locker, Inc. |

PROPOSAL 1 Signet Jewelers Limited (specialty jewelry retailer)

| VIRGINIA C. DROSOS (she/her/hers) Independent Director Age: 61 Director since: 2022 | |

| PROFESSIONAL EXPERIENCE | | | | Signet Jewelers Limited (specialty jewelry retailer) | | | | ► | Chief Executive Officer, since August 2017 |

Assurex Health, Inc. (personalized medicine company)

| ► | | OTHER BOARD SERVICE | | President and Chief Executive Officer, August 2013 to July 2017 |

OTHER BOARD SERVICE

| ► | Director, Signet Jewelers Limited, since 2012 |

| | | ► | Executive Committee Member, United States Golf Association, since February 2024 | | | | ► | Director, Akron Children’s Hospital, since April 2019 |

| | | ► | Director, American Financial Group, Inc., 2013 to December 2021 |

| ► | Director, Assurex Health, Inc., August 2013 to July 2017 |

REASONS FOR NOMINATION

Ms. Drosos brings valuable skills and insights to the Board, including proven expertise in strategy, branding, marketing, digital commerce, and global operations. She has proven retail expertise in mergers and acquisitions and business expansions into new product lines, retail channels, and geographies. Ms. Drosos is the sitting CEO of a specialty retailer, she is a visionary and transformational leader with an entrepreneurial mindset, and she has a proven track record of growing and scaling global businesses through deep consumer understanding, product and experience innovation, and heightened employee engagement. Further, Ms. Drosos is actively involved in financial planning issues as the CEO of a public company, providing her with relevant expertise as a member of the Audit Committee and Finance Committee.

COMMITTEES | RELEVANT SKILLS | A F |  |

| ALAN D. FELDMAN | | Independent Director | Age: 70 | Director since: 2005

| | | | | REASONS FOR NOMINATION | | | | Ms. Drosos brings valuable skills and insights to the Board, including proven expertise in retail, strategy, branding, marketing, digital commerce, and global operations. Ms. Drosos is the sitting CEO of a specialty retailer, she is a visionary and transformational leader with an entrepreneurial mindset, and she has a proven track record of growing and scaling global businesses through deep consumer understanding, product and experience innovation, and heightened employee engagement. Further, Ms. Drosos is actively involved in financial planning, risk management, and technology issues as the CEO of a public company, providing her with relevant expertise as a member of the Audit Committee and Technology Committee, respectively. |

PROFESSIONAL EXPERIENCE

Midas, Inc. (automotive repair and maintenance service provider)

| COMMITTEES | RELEVANT SKILLS | | A T | |

| GUILLERMO G. MARMOL (he/him/his) Independent Director Age: 71 Director since: 2011 | ► |

| PROFESSIONAL EXPERIENCE | | Chairman, President | Porosome Therapeutics, Inc. (formerly known as Viron Therapeutics Holdings, Inc.) (medicine and Chief Executive Officer, May 2006 to April 2012therapeutics company) |

| | | ► | President and Chief Executive Officer, January 2003 to April 2006 |

OTHER BOARD SERVICE

| ► | Director, John Bean Technologies Corporation, since July 2008 |

| ► | Director, GNC Holdings, Inc., June 2013 to June 2020 |

| ► | Director, Foundation Board, University of Illinois Foundation, since September 2012 |

REASONS FOR NOMINATION

Mr. Feldman has extensive chief executive, financial, and franchised retail experience as the former CEO of a public company specializing in retail franchises, providing him with relevant expertise as a member of the Human Capital Committee and Finance Committee.

COMMITTEES | RELEVANT SKILLS | F H |  |

| 2022 PROXY STATEMENT |  19

|

PROPOSAL 1: ELECTION OF DIRECTORS

| GUILLERMO G. MARMOL | | Independent Director | Age: 69 | Director since: 2011

2021 | | | |

PROFESSIONAL EXPERIENCE

Marmol & Associates (consulting firm that provides advisory services and investment capital to early-stage technology companies)

| Marmol & Associates (consulting firm that provides advisory services and investment capital to early-stage technology companies) | | | | ► | President, since March 2007 and October 2000 to May 2003 |

OTHER BOARD SERVICE

| ► | | OTHER BOARD SERVICE | | Non-executive Chief Executive Officer, Viron Therapeutics Holdings Inc., since 2021 |

| ► | Chair of the Board of Trustees, Center for a Free Cuba | | | | ► | Director and Audit Committee member, Morae Global Corporation, until August 2021 |

| | | ► | Director, Vitamin Shoppe, Inc., February 2016 to December 2019 |

| ► | Chair of the Board of Trustees, Center for a Free Cuba |

REASONS FOR NOMINATION

Mr. Marmol has a significant background in information technology and systems, which is highly important to the Company as we continue to invest in our technology and systems and build a more powerful digital business to connect with our customers. Mr. Marmol also has extensive executive, financial, strategic analysis, and business process experience as a management consultant at Marmol & Associates and McKinsey & Company and a former senior executive officer of Luminant Worldwide Corporation, Electronic Data Systems Corporation, and Perot Systems Corporation, providing him with relevant expertise as a member of the Human Capital Committee and Audit Committee Chair.

COMMITTEES | RELEVANT SKILLS |

|  |

| DARLENE NICOSIA | | | Independent Director | Age: 54 | Director since: 2020

REASONS FOR NOMINATION | | | | | Mr. Marmol has a significant technology background, which is critical to the Company as it invests in technology and systems to build more powerful digital engagement with customers. Mr. Marmol also has extensive financial, strategy, and management resources experience as a management consultant at Marmol & Associates and McKinsey & Company and a former senior executive officer of Luminant Worldwide Corporation, Electronic Data Systems Corporation, and Perot Systems Corporation, providing him with relevant expertise as Audit Committee Chair and a member of the HCC Committee. |

| COMMITTEES | RELEVANT SKILLS | | |

PROFESSIONAL EXPERIENCE

| 2024 PROXY STATEMENT |  16 |

PROPOSAL 1 The Coca-Cola Company (beverage company)

| DARLENE NICOSIA (she/her/hers) Independent Director Age: 56 Director since: 2020 | |

| PROFESSIONAL EXPERIENCE | | | | Hearthside Food Solutions LLC (manufacturer of packaged foods) | | | | ► | Chief Executive Officer, since August 2022 | | | | The Coca-Cola Company (beverage company) | | | | ► | President, Canada and Northeast U.S., North America Operating Unit, since January 2021 to August 2022 |

| | | ► | President of the Canada Business Unit, January 2019 to January 2021 |

| | | ► | Vice President, Commercial Product Supply, May 2016 to January 2019 |

OTHER BOARD SERVICE

| | | OTHER BOARD SERVICE | | | | ► | Advisory Board Member, Georgia Institute of Technology, Scheller College of Business |

| ► | Chair of the Board, Canadian Beverage Association |

| ► | Member, Food, Health, and Consumer Products of Canada Association |

REASONS FOR NOMINATION

Ms. Nicosia brings to our Board a broad-based global business background, particularly brand-building and global supply chain management, gained through her experience in the consumer products industry. Throughout her career, Ms. Nicosia has led sustainability initiatives and navigated complex regulatory environments and shifting consumer preferences. Her extensive understanding of supply chain, marketing operations, third-party risk management, and business transformation is an asset to our Board, particularly our Audit Committee and Human Capital Committee.

COMMITTEES | RELEVANT SKILLS | A H |  |

20

| Foot Locker, Inc. | |

PROPOSAL 1: ELECTION OF DIRECTORS

| STEVEN OAKLAND | | | Independent Director► | Age: 61 | Director since: 2014

Member, American Bakers Association | | | | | REASONS FOR NOMINATION | | | | Ms. Nicosia brings to our Board a broad-based global business background, particularly brand-building and global supply chain management, gained through her experience in the consumer- packaged goods industry. Throughout her career, Ms. Nicosia has navigated complex regulatory environments and shifting consumer preferences. Her extensive understanding of supply chain, risk management, and management resources is an asset to our Board, particularly the Audit Committee and HCC Committee. In addition, Ms. Nicosia qualifies as an “Audit Committee Financial Expert,” as defined by the rules under the Exchange Act, through her relevant experience as a sitting CEO, and her prior experience as president of an operating unit of a large multinational corporation where she supervised the finance and accounting professionals responsible for, and personally analyzed and evaluated, financial statements, as well as internal controls over financial reporting. |

PROFESSIONAL EXPERIENCE

TreeHouse Foods, Inc. (manufacturer of packaged foods and beverages)

| COMMITTEES | RELEVANT SKILLS | | A H | |

| STEVEN OAKLAND (he/him/his) Independent Director Age: 63 Director since: 2014 | |

| PROFESSIONAL EXPERIENCE | | | | TreeHouse Foods, Inc. (manufacturer of packaged foods and beverages) | | | | ► | Chairman, since April 2023 | | | | ► | Chief Executive Officer and President, since March 2018 |

The J.M. Smucker Company (manufacturer of packaged foods and beverages)

| ► | | OTHER BOARD SERVICE | | Vice Chair and President, U.S. Food and Beverage, May 2016 to March 2018 |

| ► | President, Coffee and Foodservice, April 2015 to April 2016 |

OTHER BOARD SERVICE

| ► | Director, TreeHouse Foods, Inc.The Green Coffee Co. |

| ► | Director and member of Compensation committee, Foster Farms |

| ► | Director, Food Industry Association |

| | | ► | Director, MTD Products, Inc., until December 2021 |

REASONS FOR NOMINATION

Mr. Oakland brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strengths around business development, mergers and acquisitions, risk management, strategic planning, customer engagement, marketing, and brand building. Mr. Oakland is actively involved in governance and financial matters as the sitting CEO of a public company, providing him with relevant expertise as a member of the Responsibility Committee and Finance Committee Chair.

COMMITTEES | RELEVANT SKILLS |

|  |

| ULICE PAYNE, JR. | | | Independent Director | Age: 66 | Director since: 2016

REASONS FOR NOMINATION | | | | | Mr. Oakland brings to our Board a broad-based business background and extensive experience in domestic and international consumer-packaged goods, with particular strengths around corporate development, risk management, strategic planning, customer engagement, marketing, and brand building. Mr. Oakland is actively involved in technology and governance matters as the sitting CEO of a public company, providing him with relevant expertise as Technology Committee Chair and a member of the NCR Committee. |

| COMMITTEES | RELEVANT SKILLS | | |

PROFESSIONAL EXPERIENCE

17 | Foot Locker, Inc. |

PROPOSAL 1 Cyber-Athletix, LLC (esports healthcare company)

| ULICE PAYNE, JR. (he/him/his) Independent Director Age: 68 Director since: 2016 | |

| PROFESSIONAL EXPERIENCE | | | | Cyber-Athletix, LLC (esports healthcare company) | | | | ► | President, since March 2021 |

Addison-Clifton, LLC (global trade compliance advisory services provider)

| | | Addison-Clifton, LLC (global trade compliance advisory services provider) | | | | ► | President and Managing Member, since May 2004 |

OTHER BOARD SERVICE

| | | OTHER BOARD SERVICE | | | | ► | Director and member of the Audit and Governance and Sustainability committees, ManpowerGroup, Inc. |

| | | ► | Director, Chair of the Compensation Committee, and member of the Finance Committee, and Compensation Committee Chair, WEC Energy Group, Inc. |

| | | ► | Director, Wisconsin Conservatory of Music |

| ► | Director, The Northwestern Mutual Life Insurance Company, January 2005 to May 2018 |

REASONS FOR NOMINATION

Mr. Payne brings to our Board significant governance, operational, financial, public service, trade compliance, and international experience as a result of the many senior positions he has held, including as President and Managing Member of Addison-Clifton, LLC since May 2004, President and Chief Executive Officer of the Milwaukee Brewers Baseball Club from September 2002 to December 2003, Managing Partner of Foley & Lardner, LLP from 2001 to 2002, Partner of Foley & Lardner, LLP from February 1998 to September 2002, and the Wisconsin Commissioner of Securities from February 1985 to December 1987. Mr. Payne’s extensive experience provides him with relevant expertise as a member of the Audit Committee and Responsibility Committee Chair.

COMMITTEES | RELEVANT SKILLS |

|  |

| | 2022 PROXY STATEMENT |  21

|

PROPOSAL 1: ELECTION OF DIRECTORS

| KIMBERLY UNDERHILL | | | Independent Director | Age: 57 | Director since: 2016

REASONS FOR NOMINATION | | | | | Mr. Payne brings to our Board significant governance, operational, financial, public service, trade compliance, and international experience as a result of the many senior positions he has held, including as President and Managing Member of Addison-Clifton, LLC, President and Chief Executive Officer of the Milwaukee Brewers Baseball Club, Managing Partner of Foley & Lardner, LLP, and the Wisconsin Commissioner of Securities. Mr. Payne’s extensive experience provides him with relevant expertise as NCR Committee Chair and a member of the Audit Committee. |

PROFESSIONAL EXPERIENCE

Boston Consulting Group (management consulting firm)

| COMMITTEES | RELEVANT SKILLS | | |

| KIMBERLY UNDERHILL (she/her/hers) Independent Director Age: 59 Director since: 2016 | |

| PROFESSIONAL EXPERIENCE | | | | Boston Consulting Group (management consulting firm) | | | | ► | Senior Advisor, since November 2021 |

Kimberly-Clark Corporation (manufacturer of branded personal care, consumer tissue, and professional healthcare products)

| | | Kimberly-Clark Corporation (manufacturer of branded personal care, consumer tissue, and professional healthcare products) | | | | ► | President, North America Consumer, May 2018 to September 2021 |

| ► | | OTHER BOARD SERVICE | | Global President | | ► | Director and member of Kimberly-Clark Professional, April 2014 tothe Audit, Development, and Remuneration committees, Glanbia PLC, since August 2022 | | | | ► | Director and member of the Audit and Compensation committees, Menasha Corporation, since May 20182022 |

OTHER BOARD SERVICE

| | | ► | Advisory board member,Board Member, Rawhide Youth Services |

| | | ► | Director, Board of Trustees, ThedaCare |

| | | ► | Co-Chair and Leadership Giving Chair, United Way Fox Cities Campaign |

| | | ► | Director and Compensation Committee Chair, Network of Executive Women, until 2021 |

| ► | Director, Kimberly-Clark de Mexico, S.A.B. de C.V., until September 2021 |

| ► | Director, Food Industry Association, until 2021 |

REASONS FOR NOMINATION

Ms. Underhill brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strengths in marketing, brand building, strategic planning, international business, and business development. She is NACD Directorship CertifiedTM. Ms. Underhill’s management resources experience from her prior service as a senior executive of a public company is relevant to both our Human Capital Committee, of which she is Chair, and Responsibility Committee, of which she is a member.

COMMITTEES | RELEVANT SKILLS |

|  |

| TRISTAN WALKER | | | Independent Director | Age: 37 | Director since: 2020

REASONS FOR NOMINATION | | | | | Ms. Underhill brings to our Board extensive consumer-packaged goods experience with particular strengths in marketing, brand building, strategic planning, and corporate development. She is NACD Directorship CertifiedTM. Ms. Underhill’s management resources experience from her prior service as a senior executive of a public company is relevant to both our HCC Committee, of which she is Chair, and NCR Committee, of which she is a member. |

| COMMITTEES | RELEVANT SKILLS | | |

PROFESSIONAL EXPERIENCE

| 2024 PROXY STATEMENT |  18 |

PROPOSAL 1 Walker & Company Brands Inc. (manufacturer of health and beauty products for persons of color), a subsidiary of the Procter & Gamble Company

| TRISTAN WALKER (he/him/his) Independent Director Age: 39 Director since: 2020 | ► | Founder and Chief Executive Officer, since April 2013 |

Heirloom Management Company, LLC (micro venture capital fund)

| PROFESSIONAL EXPERIENCE | | | | Heirloom Management Company, LLC (micro venture capital fund) | | | | ► | Managing Member, since March 2022 |

OTHER BOARD SERVICE

| | | Walker & Company Brands Inc. (manufacturer of health and beauty products for persons of color), a subsidiary of the Procter & Gamble Company | | | | ► | Founder and Chief Executive Officer, April 2013 to 2023 | | | | OTHER BOARD SERVICE | | | | ► | Director and member of the Nominating and Corporate Governance Committee, Shake Shack, Inc. |

| | | ► | Trustee, Children’s Healthcare of Atlanta |

| | | ► | Chairman, CODE2040 (non-profit organization that matches high-performing Black and Latino software engineering students and graduates with technology firms and start-ups), until January 2020 | | | | REASONS FOR NOMINATION | | | | Mr. Walker’s brand marketing and technology experience are deeply connected to the mission of designing solutions for consumers. Mr. Walker understands how to utilize innovation and technology to drive change and deliver growth. His experience at the intersection of technology and consumer insights benefits our Technology Committee, and his experience as a former CEO provides him with relevant expertise as a member of the NCR Committee. |

| COMMITTEES | RELEVANT SKILLS | | N T | |

REASONS FOR NOMINATION

19 | Foot Locker, Inc. |

PROPOSAL 1 Mr. Walker’s brand marketing and technology experience are deeply connected to the mission of designing solutions for consumers while bridging the gap between technology product innovation and youth culture. Mr. Walker understands how to utilize innovation and technology to drive change and deliver growth. His work at the intersection of technology and the consumer experience benefits our Board, and his financial and ESG experience as a CEO provides him with relevant expertise as a member of the Finance Committee and Responsibility Committee.

COMMITTEES | RELEVANT SKILLS | F R |  |

22

| Foot Locker, Inc. | |

PROPOSAL 1: ELECTION OF DIRECTORS

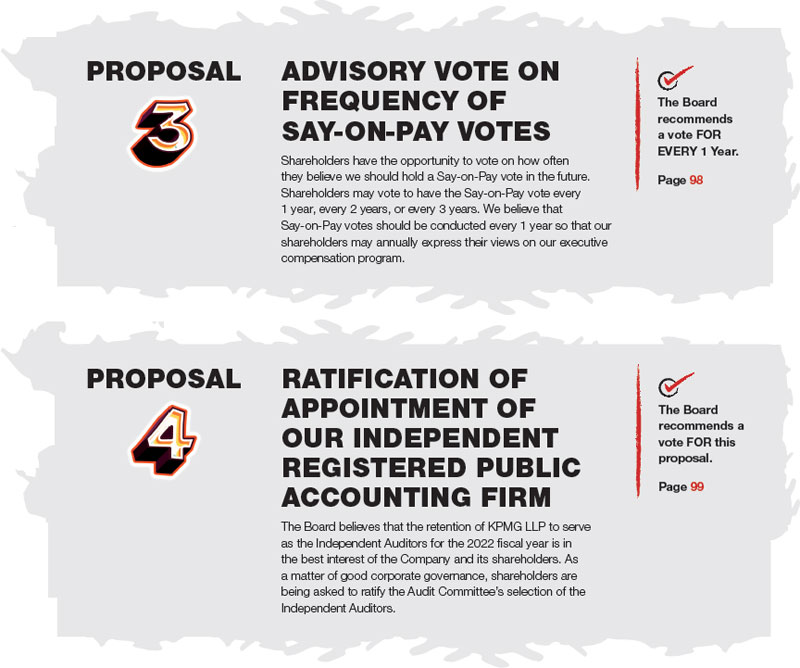

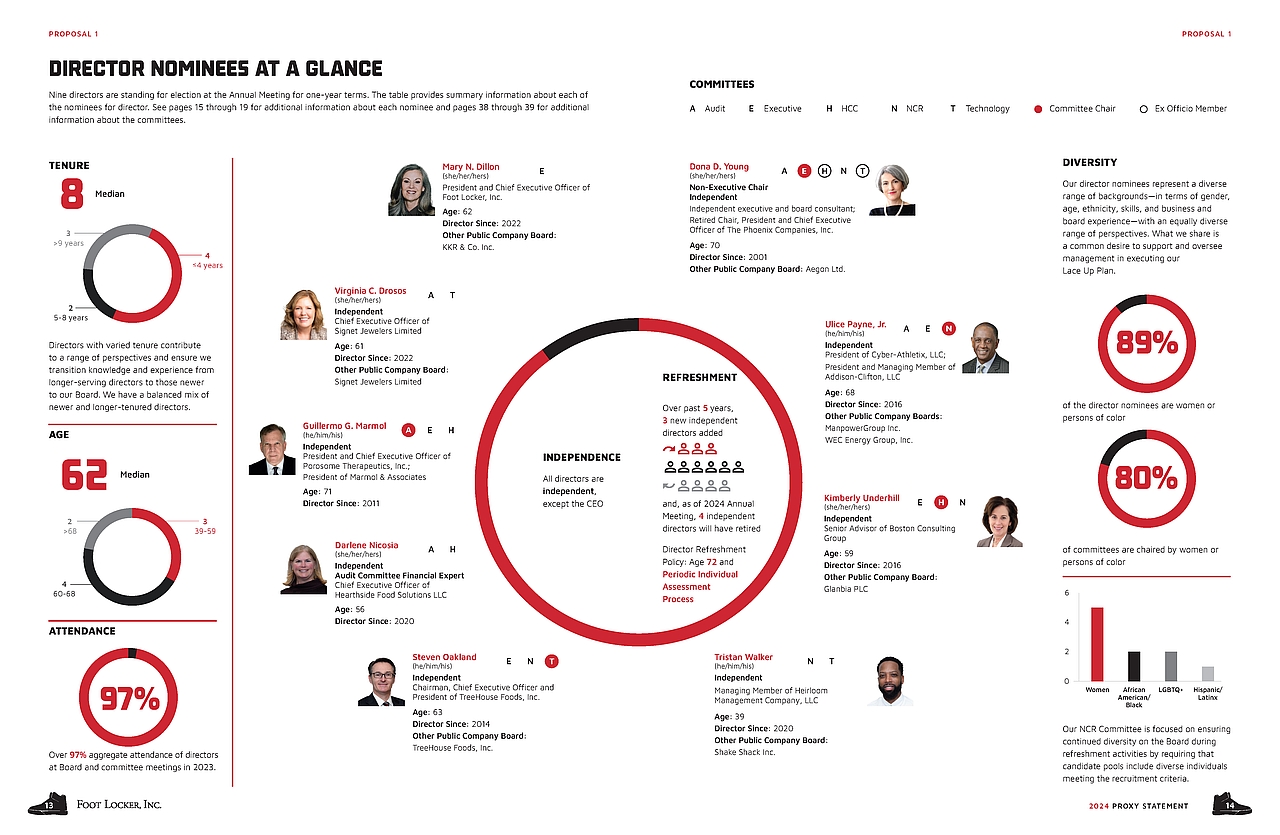

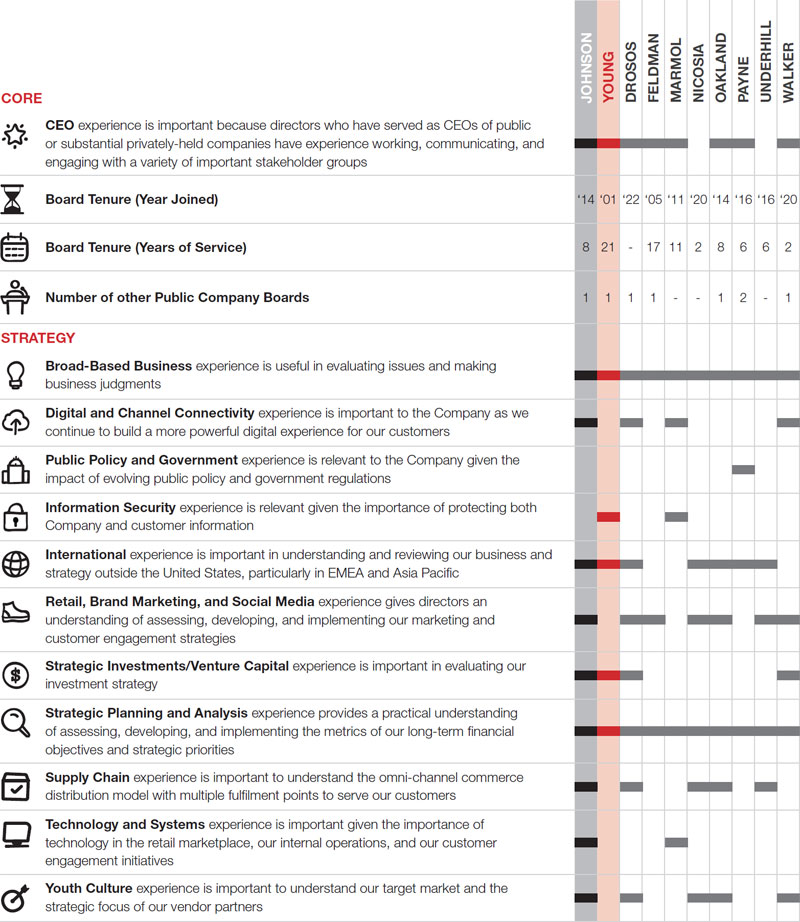

DIRECTOR NOMINEES’ SKILLSET MATRIX We believe that the director nominees possess the appropriate mix of diversity in terms of gender, age, ethnicity, skills, business and Board experience, and viewpoints. We have refreshed our Board over the past five years, as fivethree highly-qualified independent directors were added to the Board, and as of the Annual Meeting, fivewith Mr. Feldman’s upcoming retirement, four independent directors will have retired during that time period.retired.

21 | 2022PROXY STATEMENT |  23

Foot Locker, Inc. |

PROPOSAL 1: ELECTION OF DIRECTORS1 Each director is individually qualified to make unique and substantial contributions. Collectively, our directors’ diverse viewpoints and independent-mindedness enhance the quality and effectiveness of Board deliberations and decision making. This blend of qualifications, attributes, and tenure results in highly-effective oversight.

| 2024 PROXY STATEMENT |  22 |

GOVERNANCE  24

| Foot Locker, Inc. | |

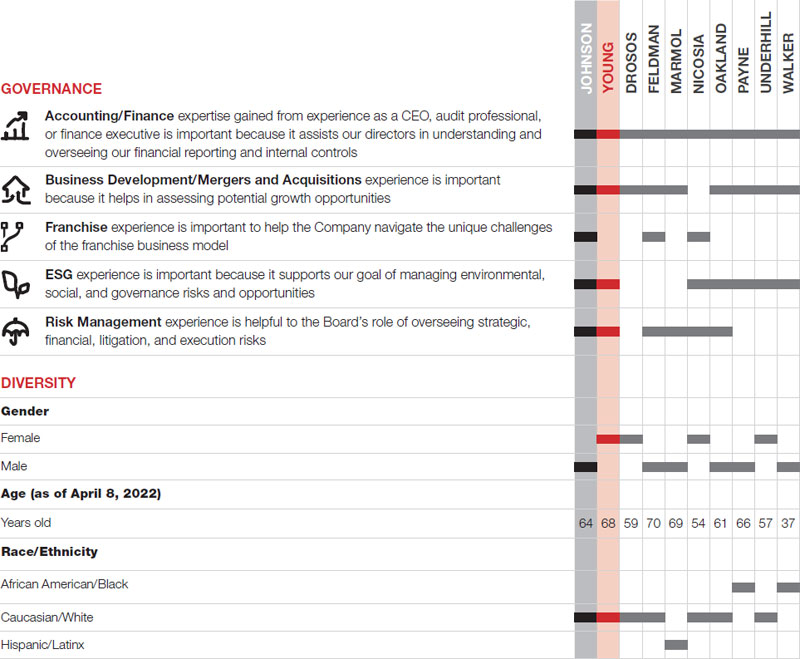

OUR BOARD OF DIRECTORS | | Our Board consists of individuals from a diverse range of backgrounds—in terms of gender, age, ethnicity, skills, and business and Board experience—with an equally diverse range of perspectives. What our Board shares is a common desire to support and oversee management in executing our Lace Up Plan. Our Bylaws provide for a Board consisting of between seven and thirteen directors. The exact number of directors is determined from time to time by the Board. There are currently ten directors on our Board. Mr. Feldman, who has reached the retirement age under our Corporate Governance Guidelines, will not stand for re-election and will retire when his term expires at the conclusion of the 2024 Annual Meeting. Upon the recommendation of our NCR Committee, the Board has decided to decrease the size of the Board from ten to nine directors at this time, effective upon Mr. Feldman’s retirement from the Board. The Board has delegated certain duties to its committees, which assist the Board in carrying out its responsibilities. There are five standing committees of the Board. Each independent director serves on at least two committees. |

The Board has adopted charters for each of the Audit Committee (investors.footlocker-inc.com/audit), HCC Committee (investors.footlocker-inc.com/comp), NCR Committee (investors.footlocker-inc.com/gov), and Technology Committee (investors.footlocker-inc.com/tech). Our By-Laws provide forAs a Board consisting of between 7 and 13 directors. The exact number of directors is determined from time to time by the entire Board. There are currently 11 directors on our Board. Mr. McKenna will be retiring when his term expires at the conclusion of the Annual Meeting, andgeneral principle, the Board has fixedbelieves that the numberperiodic rotation of directors at 10 effective at such time.committee and committee chair assignments on a staggered basis provides opportunities to foster diverse perspectives, develops further the depth and breadth of knowledge within the Board, and prepares the Board for future director succession.

DIRECTORS’ INDEPENDENCECORPORATE GOVERNANCE GUIDELINES

The Corporate Governance Guidelines assist the Board in the exercise of its governance responsibilities and serve as a framework within which the Board may conduct its business, including the following duties: | | | | | | | ► | Director Responsibilities | ► | Human Capital Management and | ► | CEO and Board Evaluations | | | | Succession Planning Oversight | | | | ► | Board Leadership and Committees | | | ► | Director Qualifications | | | ► | Director Independence | | | | ► | Change in Director’s Principal | | | ► | Director Refreshment Policy | | Employment | ► | Director Resignation Policy | | | | | | | ► | Board Meeting Agendas | | ► | Media and Stakeholder | ► | Board Access to Management and | | | | Engagement | | Independent Advisors | ► | Director Compensation | | | | | | | | ► | Stock Ownership Guidelines | ► | Director On-Boarding | ► | Director Continuing Education | | | | | | | | | | | ► | Outside Directorships Policy | | | | | | |

The Board periodically reviews the guidelines and revises them, as appropriate. The Corporate Governance Guidelines are available at investors.footlocker-inc.com/cgg.  23 | Foot Locker, Inc. |

gOvERNaNCE DIRECTORS’ INDEPENDENCE A director is not considered independent under NYSE rules if they have a material relationship with the Company that would impair their independence. In addition to the independence criteria established by the NYSE, the Board has adopted categorical standards to assist it in making its independence determinations regarding individual directors. These categorical standards are contained in the Corporate Governance Guidelines, which are available at investors.footlocker-inc.com/cgg. The Board has determined that the following categories of relationships are immaterial for purposes of determining whether a director is independent under the NYSE listing standards: | Categorical Relationship | | Description | | | | | Investment Relationships with the Company | | A director and any family member may own equities or other securities of the Company. | | | | | | | | Relationships with Other Business Entities | | A director and any family member may be a director, employee (other than an executive officer), or beneficial owner of less than 10% of the shares of a business entity with which the Company does business, provided that the aggregate amount involved in a fiscal year does not exceed the greater of $1 million or 2% of either that entity’sentity or the Company’s annual consolidated gross revenue. | | | | | | | | Relationships with Not-for-Profit Entities | | A director and any family member may be a director or employee (other than an executive officer or the equivalent) of a not-for-profit organization to which the Company (including the Foot Locker Foundation) makes contributions, provided that the aggregate amount of the Company’s contributions in any fiscal year do not exceed the greater of $1 million or 2% of the not-for-profit entity’s total annual receipts. | | | |

We individually inquire of each of our directors and executive officers about any transactions in which the Company and any of these related persons or their immediate family members are participants. We also make inquiries within the Company’s records for information on any of these kinds of transactions. Once we gather the information, we then review all relationships and transactions of which we are aware in which the Company and any of our directors, executive officers, their immediate family members, or 5% shareholders are participants to determine, based on the facts and circumstances, whether the related persons have a direct or indirect material interest. Our General Counsel’s office coordinates the related person transaction review process. The Responsibilityprocess, and the NCR Committee reviews any potential related person transactions reported transactionsto, and referred by, our General Counsel’s office involving directors and their immediate family members in making its recommendation to the Board onconcerning the independence of the directors. In approving, ratifying, or rejecting a related person transaction, the ResponsibilityNCR Committee considers such information as it deems important to determine whether the transaction is on reasonable and competitive terms and is fair to the Company. The Company’s written policies and procedures forThere were no related person transactions are included within bothin 2023. See the Corporate Governance Guidelines and the Code of Business Conduct. There were no related person transactions in 2021.Conduct for further information. | 20222024PROXY STATEMENT |  24 |  25

|

GOVERNANCEgOvERNaNCE

The Board, upon the recommendation of the ResponsibilityNCR Committee, has determined that the following directors are independent under the NYSE rules because they have no material relationship with the Company that would impair their independence:  |  |  |  |  | DONA D.

YOUNG

Age: 68

Director since: 2001

Lead Independent

Director

| VIRGINIA C.

DROSOS

Age: 59

Director since: 2022

| ALAN D.

FELDMAN

Age: 70

Director since: 2005

| GUILLERMO G.

MARMOL

Age: 69

Director since: 2011

| MATTHEW M.

MCKENNA

Age: 71

Director since: 2006

|

|  |  |  |  | DARLENE

NICOSIA

Age: 54

Director since: 2020

| STEVEN

OAKLAND

Age: 61

Director since: 2014

| ULICE

PAYNE, JR.

Age: 66

Director since: 2016

| KIMBERLY

UNDERHILL

Age: 57

Director since: 2016

| TRISTAN

WALKER

Age: 37

Director since: 2020

|

directors are independent. All

directors are independent,

except the CEO.

| Maxine Clark served as a director of the Company during 2021 until her retirement from the Board in May 2021. The Board determined that Ms. Clark was independent under NYSE rules through the end of her term as a director because she had no material relationship with the Company that would impair her independence.

In making its independence determination, the Board reviewed recommendations of the Responsibility Committee and considered Mr. Payne and Ms. Young’s relationships as directors of companies with which we do business. The Board has determined that these relationships meet the categorical standard for Relationships with Other Business Entities and areIn making its independence determination, the Board reviewed recommendations of the NCR Committee and considered Ms. Young’s relationship as a director of a company with which we do business. The Board determined that this relationship meets the categorical standard for Relationships with Other Business Entities and is immaterial with respect to determining independence.

The Board has determined that all members of the Audit Committee, the Finance Committee, the Human Capital Committee, and the Responsibility Committee are independent as defined under the NYSE listing standards and the director independence standards adopted by the Board.

|

26

| Foot Locker, Inc. | |

GOVERNANCE

BOARD TENURE AND TERM LIMITS

The Company is focused on having a well-constructed and high-performing Board. To that end, the Responsibility Committee selects director nominees who think and act independently and can clearly and effectively communicate their convictions. The Board does not believe long tenure alone presumptively renders a director to not be independent. Conversely, the Board recognizes the contributions experienced directors add to the Board. The Board has determined that its longer-tenured directors have important experience, bring diverse perspectives,all members of the Audit Committee, HCC Committee, NCR Committee, and provide tangible value toTechnology Committee are independent as defined under the BoardNYSE listing standards and the Company. The Board has also determined that their length of tenure has allowed these directors to accumulate valuable knowledge and experience based upon their history with the Company. This knowledge and experience improves the ability of the Board to provide constructive guidance and informed oversight to management. Furthermore, in the Board’s opinion, the length of tenure of its members has not in any way impaired the willingness of any director to question and confront any issue or exercise independent and impartial oversight of the Company in any area. The Board benefits from the contributions of its experienced directors who have developed insight into the Company over the course of their service onindependence standards adopted by the Board.

The Responsibility Committee has specifically considered the feedback of some shareholders as well as the discussions of some commentators that suggest lengthy Board tenure should be balanced with new perspectives. Specific to the Company, the Responsibility Committee has structured the Board such that there are directors of varying tenures, with new directors and perspectives joining the Board over time while retaining the institutional memory of longer-tenured directors. Longer-tenured directors, balanced with newer directors, enhance the Board’s oversight capabilities. The Board believes it is important to balance refreshment with the need to retain directors who have developed, over time, significant insight into the Company and its operations and who continue to make valuable contributions to the Company that benefit our shareholders. The Board believes that it has an appropriate mix of longer-tenured directors and newer directors, which provides an appropriate and dynamic balance.

25 | Foot Locker, Inc. |

gOvERNaNCE Furthermore, the Board has not adopted formal director term limits, in part, because the imposition of director term limits on a board implicitly discounts the value of experience and continuity among directors and runs the risk of excluding experienced and potentially valuable directors as a result of an arbitrary determination. In addition, imposing this restriction means the Board would lose the contributions of longer-tenured directors who have developed a deeper knowledge and understanding of the Company over time. The Board does not believe that long tenure impairs a director’s ability to act independently of management.

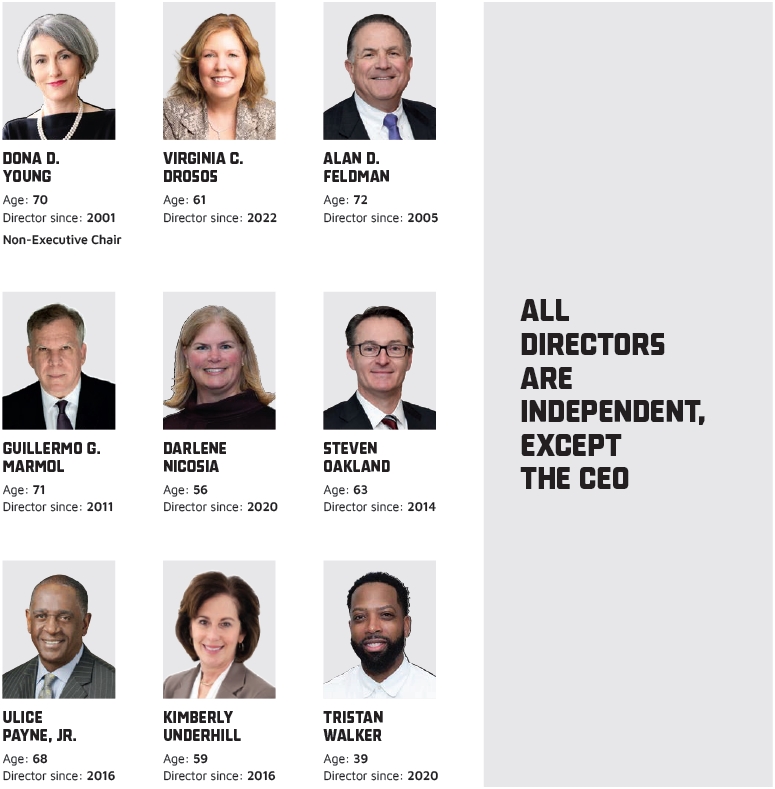

BOARD LEADERSHIP STRUCTURE Our Board evaluates, from time to time as appropriate, whether the same person should serve as Chairman and CEO, or whether the positions should be held by different persons, in light of all relevant facts and circumstances and what it considers to be in the best interests of the Company and our shareholders. Since May 2016, theThe positions of ChairmanChair and CEO have been held by Mr. Johnson,are currently separated with Ms. Young serving as Lead Independent Director. The Board has utilized various leadership structures since 2010,Non-Executive Chair and Ms. Dillon serving as shown below:

CEO. The Board believes that, basedits current leadership structure best serves the Board’s oversight of management, the Board’s carrying out of its responsibilities on the shareholders’ behalf, and the Company’s current factsoverall corporate governance at this time. The Board also believes the separation of the roles allows the CEO to focus her efforts on operating and circumstances, its Board leadership structure is appropriate.managing the Company. | 2022PROXY STATEMENT |  27

|

GOVERNANCE

LEAD INDEPENDENT DIRECTORMAJORITY VOTING IN THE ELECTION OF DIRECTORS

The Board believes that, because the positions of Chairman and CEO are combined,Directors must be elected by a lead independent director is appropriate.

The Lead Independent Director’s responsibilities include:

| ► | presiding at executive sessions of the independent directors, and Board meetings at which the Chairman is absent; |

| ► | attending meetings of each of the Board committees; |

| ► | encouraging and facilitating active participation by, and communication among, all directors; |

| ► | serving as the liaison between the independent directors and the Chairman; |

| ► | approving Board meeting agendas and schedules after conferring with the Chairman and other members of the Board, as appropriate, and adding agenda items in her discretion; |

| ► | possessing the authority to call meetings of the independent directors; |

| ► | leading the Board’s annual CEO performance evaluation; |

| ► | advising the Chairman and the committee chairs in fulfilling their designated roles and responsibilities; and |

| ► | performing such other functions as the Board or other directors may request. |

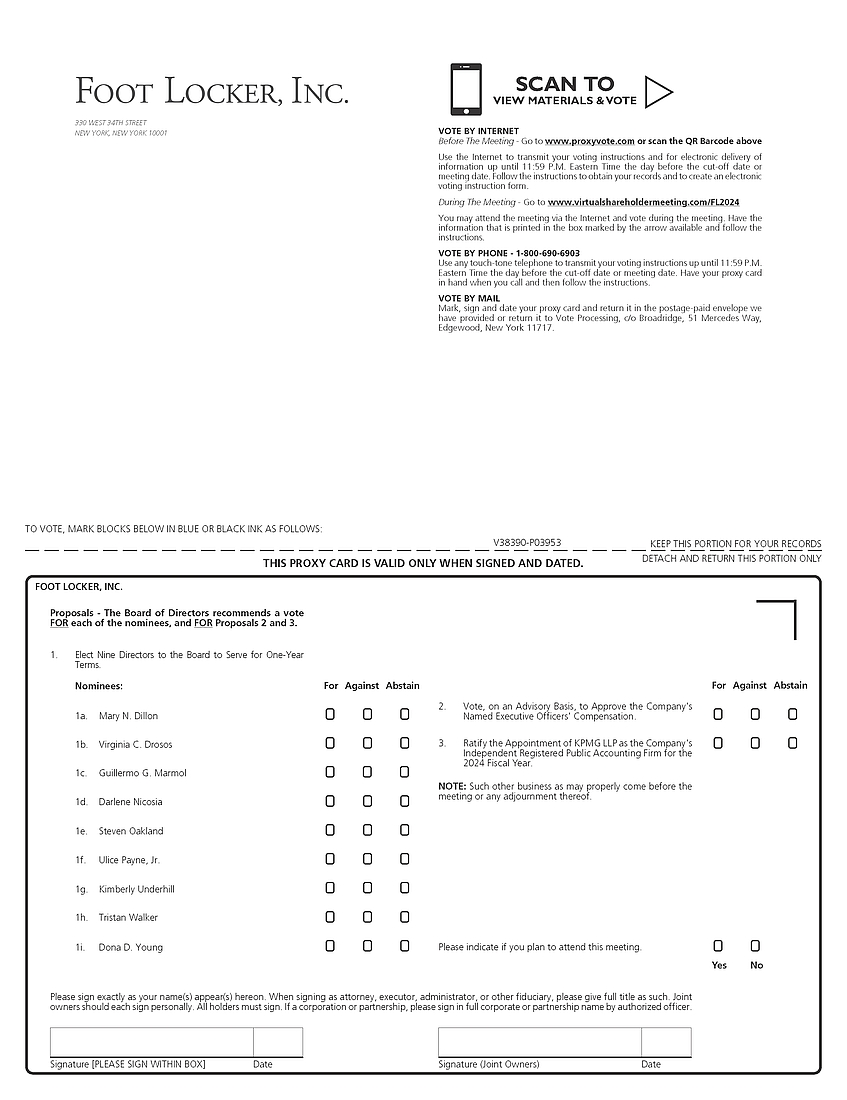

The Board periodically considers the rotationmajority of the Lead Independent Director, taking into account experience, continuityvotes cast in uncontested elections, and a plurality of leadership, andthe votes cast in contested elections. Our Corporate Governance Guidelines provide that any incumbent director who does not receive a majority of the votes cast in an uncontested election is required to tender their resignation for consideration by the NCR Committee. The NCR Committee will make a recommendation to the Board whether to accept or reject the resignation, or take other action based upon the best interests of the Company.Company and its shareholders. In determining its recommendation to the Board, the NCR Committee shall consider all factors that it deems relevant. The director who tenders their resignation will not participate in the NCR Committee or Board’s decision. Following such determination, the Company will promptly publicly disclose the Board’s decision, including, if applicable, the reasons for rejecting the tendered resignation.

Ms. YoungPROXY ACCESS

Under our proxy access bylaw, a shareholder, or a group of up to 20 shareholders, owning at least 3% of the Common Stock continuously for at least three years as of the date of the notice of nomination, may nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board, whichever is greater (subject to certain limitations set forth in the Bylaws), provided that the shareholder(s) and nominee(s) satisfy the requirements specified in the Bylaws. DIRECTOR REFRESHMENT POLICY, BOARD TENURE, AND TERM LIMITS The Company is focused on having a well-constructed and high-performing Board, and recognizes the importance of Board refreshment. To that end, the Company has a healthy director refreshment policy that combines a retirement age (age 72) and a periodic individual assessment process with the annual election of directors. Over the past five years, we have added three highly-qualified independent directors to the Board, and with Mr. Feldman’s upcoming retirement, four independent directors will have retired over that same time period. The Board’s median tenure is currently serveseight years, consistent with other leading companies. This reflects the balance the Board brings to refreshment while maintaining the benefits of experience. The NCR Committee selects director nominees who think and act independently and can clearly and effectively communicate their convictions. The Board does not believe long tenure alone presumptively renders a director to not be independent. Conversely, the Board has determined that its longer-tenured directors have important experience, bring diverse perspectives, and provide tangible value to the Board and the Company. The Board has also determined that their length of tenure has allowed these directors to accumulate valuable knowledge and experience based upon their history with the Company and their breadth of experience in leadership roles across a range of industries outside the Company. This knowledge and experience improves the ability of the Board to provide constructive guidance and informed oversight to management. The NCR Committee has specifically considered the feedback of some shareholders as well as the Lead Independent Director.discussions of some commentators that suggest lengthy Board tenure should be balanced with new perspectives. Specific to the Company, the NCR Committee has structured the Board such that there is an appropriate mix of directors of varying tenures, with new directors and perspectives joining the Board over time while retaining the institutional knowledge and broader business experience of longer-tenured directors. This balance enhances the Board’s oversight capabilities. The Board believes that Ms. Youngit is well suitedimportant to serve as Lead Independent Director, given her governance, business, and financial background. The Board also recognizes that it benefits from Ms. Young’s tenure as an experienced directorbalance refreshment with the need to retain directors who hashave developed, over time, significant insight into the Company overand its operations and who continue to make valuable contributions to the course of her service on theCompany that benefit our shareholders. The Board which improves herdoes not believe that long tenure impairs a director’s ability to provide constructive, independent, and informed guidance and oversight toact independently of management. NOTE FROM OUR LEAD INDEPENDENT DIRECTOR

Despite the many challenges we confronted and are continuing to experience—including impacts related to the COVID-19 pandemic, supply chain disruption, inflationary pressures, and an evolving geopolitical environment—we delivered record performance in 2021. While it is important to celebrate this achievement, the Board, like management, never rests because we recognize certain headwinds in the marketplace. Our Board is engaged in confronting these challenges and believes that our strategic plan puts the Company in a position of strength. On behalf of the Board, I am pleased to share with you some highlights of the governance work we have done to navigate these challenges and make strategic choices to create long-term, consistent shareholder value:MANDATORY RESIGNATION OR RETIREMENT

| ► | Long-Term Strategy Oversight. The Board has overseen the long-term strategy initiatives implemented in 2021 to diversify our brands, categories, and channels, as well as expand our demographic and geographic customer base with the acquisitions of WSS and atmos. As the business and industry continue to evolve, the Board remains engaged and committed to accelerating certain initiatives in 2022 as a part of our long-term strategy to address the accelerated strategic shift to DTC by our vendors while also returning capital to shareholders, including further diversification of our merchandise and vendor mix, accelerating our off-mall pivot and key growth banner rollout, enhancing omni-channel evolution efforts, and implementing a new cost savings program. |

| ► | Board Refreshment. Ongoing Board refreshment is critical to ensure we have the right mix of skills, diversity, and expertise to support the Company’s progress. We recently strengthened our Board with the election of Gina Drosos in February 2022 in anticipation of Matt McKenna’s retirement from the Board in May 2022. Gina brings significant financial, industry, and operational experience from her current role as a sitting CEO of a speciality retailer. |

| ► | Succession Planning. The Board believes that a high-performing management team is critical to our success as a global brand that leads with purpose. To ensure we have the appropriate succession plan in place, the full Board is engaged in a long-term process with management to maximize the pool of emerging diverse talent who possess the skills, experiences, and attributes required to be effective leaders in light of the Company’s global business strategies, opportunities, and challenges. For additional information, see Human Capital Management and Succession Planning Oversight on page 34. |

| ► | Shareholder Engagement. Our Board serves at the pleasure of you, our shareholders. Therefore, as a Board, one of our highest priorities is hearing from you, our shareholders, who have entrusted us with this responsibility. For the past five years, I have led, on behalf of our Board, a structured and governance-focused shareholder engagement program designed to accomplish this by facilitating transparency and creating a platform to receive shareholder feedback to share with the Board. For additional information, see Shareholder Engagement on page 38. |

| ► | ESG. ESG is embedded in our ability to achieve our strategic imperatives. The Board has worked with management in its oversight capacity to support the integration of its ESG efforts into its over-arching growth strategy, as illustrated in our Impact Report. For example, we believe DIBs is a strategic business driver. Management and the Board have been tested in multiple ways throughout the pandemic and our diversity has proven to be an important asset, which has led us to make better strategic decisions. For additional information regarding our global ESG program and Board oversight, see ESG on page 96, ESG Oversight on page 35, and our Impact Report, which is available at investors.footlocker-inc.com/impactreport. |

The Board has established a policy whereby a non-employee director is incredibly gratefulrequired to all our stakeholdersadvise the NCR Committee Chair of any change to their principal employment. If requested by the NCR Committee Chair, after consultation with the other members of the NCR Committee, the director is required to submit a letter of resignation to the NCR Committee Chair, for their continued commitmentthe NCR Committee to supporting the Company.consider.  2024 PROXY STATEMENT |  “While the Board knows that it is important to celebrate the Company’s record performance in 2021, the Board, like management, never rests because we recognize certain headwinds in the marketplace and our oversight responsibility to make the strategic decisions necessary to create long-term, consistent value for you, our shareholders.”

DONA D. YOUNG26

Lead Independent Director

|

28

| Foot Locker, Inc. | |

GOVERNANCEgOvERNaNCE

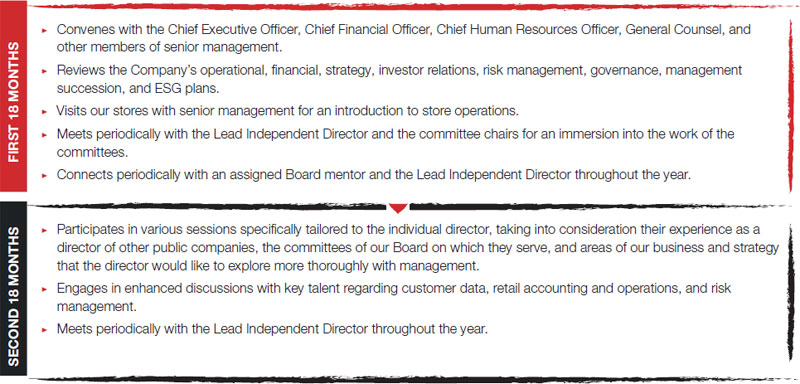

DIRECTOR ON-BOARDING We have a two-phase on-boarding program for new directors that is intended to educate a new director ondirectors about the Company and the Board’s practices:

27 | Foot Locker, Inc. |

gOvERNaNCE DIRECTOR CONTINUING EDUCATION Director education is an ongoing process, which begins when a director joins our Board. We host quarterly Board and committee presentations and separate education sessions to keep directors appropriately apprised of key developments concerning the following topics so they can effectively carry out their oversight responsibilities:

We also encourage all directors to attend otherexternal continuing education programs to maintain their expertise and share takeaways with the other directors onconcerning these programs. We reimburse directors for reasonable expenses incurred in attending continuing education programs. Our directors have attended a variety of continuing education programs, conferences, and events hosted by universities, trade groups, law firms, accounting firms, and other advisory service firms on a variety of topics, including the following:

Our directors also regularly visit our stores to engage with our Stripers, enhance their understanding of our business, witness strategy execution firsthand, and further contribute to their oversight of the Lace Up Plan. | 2022PROXY STATEMENT |  29

|

GOVERNANCE

MANDATORY RESIGNATION OR RETIREMENT

The Board has established a policy whereby a non-employee director is required to advise the Responsibility Committee Chair of any change to their principal employment. If requested by the Responsibility Committee Chair, after consultation with the other members of the Responsibility Committee, the director is required to submit a letter of resignation to the Responsibility Committee Chair, for the Responsibility Committee to consider.

The Corporate Governance Guidelines also require that directors retire from the Board at the annual meeting following the director’s 72nd birthday.

CORPORATE GOVERNANCE GUIDELINES

The Corporate Governance Guidelines assist the Board in the exercise of its governance responsibilities and serve as a framework within which the Board may conduct its business, including the following duties:

| | | ► Director Responsibilities | ► Director Independence | ► Director Qualifications | ► Board Leadership | ► Board Committees | ► Director Retirement Policy | ► Change in Director’s Principal Employment | ► Director Resignation Policy | ► Setting Board Meeting Agendas | ► Media and Stakeholder Engagement | ► Board Access to Management and Independent Advisors | ► Director Compensation | ► Stock Ownership Guidelines | ► Director On-Boarding | ► Director Continuing Education | ► Human Capital Management and Succession Planning Oversight | ► CEO and Board Evaluations | ► Policy on Outside Directorships | | | |

The Board periodically reviews the guidelines and revises them, as appropriate. The Corporate Governance Guidelines are available at investors.footlocker-inc.com/cgg.

BOARD ATTENDANCE The Board held 119 meetings during 2021.2023. Each individual director attended at least 95%85% of the aggregate of all Board and committee meetings for the committees on which they served during 2021.2023. The Board holds regularly-scheduled executive sessions of independent directors in conjunction with each Board meeting. Ms. Young, as Lead Independent Director,Non-Executive Chair, presides at these executive sessions.sessions, as well as at Board meetings. Directors are expected to attend annual meetings. The annual meeting is typically scheduled on the same day as a quarterly Board meeting. In 2021,2023, all of the directors attended the annual meeting, which was held virtually given the health and safety concerns surrounding the COVID-19 pandemic.meeting. | 2024 PROXY STATEMENT |  28 |

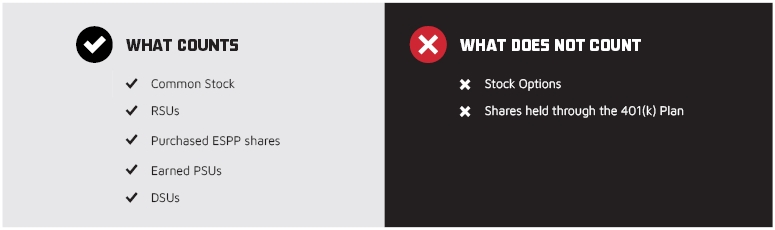

gOvERNaNCE STOCK OWNERSHIP GUIDELINES The Stock Ownership Guidelines align the interests of non-employee directors and executive officers with the interests of shareholders, and promote the Company’s sound corporate governance. The non-employee directors and executive officers are expected to achieve and maintain beneficial ownership of Common Stock having a value equal to at least the multiple indicated in the table below of the remuneration payable to them from time to time. The individual guidelines established for each participant are as follows: | Non-Employee Director and Executive Officer Position | | Multiple | | | | | | Non-Employee Director | | 4x | | | | Annual Retainer Fee (both Cash and Equity) | | Chief Executive Officer | | 6x | | | | Annual Base Salary Rate | | Executive Vice President | | 3x | | | | Annual Base Salary Rate | | Senior Vice President | | 2x | | | | Annual Base Salary Rate |

The following table illustrates which equity holdings count toward the stock ownership guidelines:  Executives and non-employee directors are required to achieve compliance within five years of their hire or promotion effective date that caused them to be covered by the guidelines, and their election to the Board, respectively. In the event of any increase in the required ownership level, either as a result of an increase in the remuneration paid or the multiple, the target date for compliance with such increase is five years after the effective date. The Company measures compliance at the end of each fiscal year, with the compliance determination at that point in time applying for the entire ensuing fiscal year, regardless of fluctuations in the Company’s stock price. In the event any person subject to these guidelines fails to comply by the applicable date, they are required to hold the net shares obtained through all future stock option exercises and RSU vestings, after withholding for the payment of applicable taxes, until such person is in compliance; provided, however, that in order to take into consideration fluctuations in the Company’s stock price, any person who has been in compliance as of the end of at least one of the two preceding fiscal years and who has not subsequently sold shares will not be subject to the holding requirements. The NCR Committee will consider a non-employee director’s failure to comply with these guidelines when considering that director for re-election to the Board. | | of directors, the CEO, and other executive officers were in compliance as of the end of Fiscal 2023 (or within the initial five-year period to achieve compliance) |

29 | Foot Locker, Inc. |

gOvERNaNCE RETENTION OF OUTSIDE ADVISORS The Board and all of its committees have authority to retain outside advisors and consultants that they consider necessary or appropriate in carrying out their respective responsibilities. The independent accountants are retained by, and report directly to, the Audit Committee. In addition, the Audit Committee is responsible for overseeing the qualifications, performance, and compensation of the internal auditors, which the Company has partially outsourced to an independent public accounting firm. Similarly, the consultant retained by the Human CapitalHCC Committee to assist in evaluating senior executive compensation reports directly to that committee.  30

| Foot Locker, Inc. | |

GOVERNANCE

BOARD EVALUATIONS The Board and its committees engage in a robust Board and committee assessment process every year, and a 360-degree peer and self-assessment facilitated by an independent third party approximately every three years, both of which are designed to elicit candid feedback regarding the areas in which the Board and its committees could improve, as described in the table below. The Board last conducted a 360-degree peer and self-assessment in 2021.2021, and plans to conduct another in 2024. Action Item | Board and Committee Assessment | | 360-Degree Peer and Self-Assessment | Cadence | Annual | | Cadence | Annual | Triennial | | Assessments | Each director completes a separate detailed assessment to evaluate the Board and each committee on which they serve. Topics covered include, among others: ► Board and committee structure, size, composition, skills, diversity, and succession planning. ► The effectiveness of the Board, committees, and committee chairs. ► Board strategy and operational oversight. ► Board culture and dynamics, including the effectiveness of discussion and debate at Board and committee meetings. ► The quality of Board and committee agendas, meeting length, and presentations. ► The appropriateness of Board and committee priorities. ► Board interactions with management, including the quality of meeting materials and the information provided to the Board and committees. | | Each independent director completes a detailed peer and self-assessment. Topics covered include, among others, whether each director: ► Demonstrates commitmentdedication to the Company’s core values. ► Participates actively and constructively in, and is well-prepared for, Board and committee meetings. ► Exercises independent judgment when considering issues before the Board and committees. ► Seeks opportunities to proactively strengthen their understanding of their role as a director and are open to ongoing training and constructive feedback. ► Brings functional expertise to the Board to augment management’s thinking and development. ► Seeks opportunities to better understand the Company’s business and issues that are important to shareholders and offers innovative solutions to these challenges. | | | | Reporting | The results of the assessments are processed as follows: ► The General Counsel reviews and summarizes the responses from each director’s assessment for the Lead Independent DirectorNon-Executive Chair and each of the committee chairs. ► Each director participates in a confidential, open-ended, one-on-one interview facilitated by the Lead Independent DirectorNon-Executive Chair to discuss the results of the assessments regarding Board and committee performance, and solicit input on the performance and effectiveness of the Board and the committees (except the Lead Independent Director,Non-Executive Chair, who meets with the ResponsibilityNCR Committee Chair). ► Each committee chair meets separately with each of its members to discuss the results of that committee’s assessment. | | The results of the peer and self-evaluations are processed as follows: ► An independent third party tabulates the results of the evaluation and prepares individual, confidential reports reflecting the directors’ peer and self-evaluation findings and recommendations. ► The reports are provided to the Lead Independent Director,Non-Executive Chair, except the report on the Lead Independent Director,Non-Executive Chair, which is provided to the ResponsibilityNCR Committee Chair. ► The Lead Independent DirectorNon-Executive Chair briefs the CEO on the results. ► Confidential, open-ended, one-on-one interviews are facilitated by the Lead Independent DirectorNon-Executive Chair and, for the Lead Independent Director,Non-Executive Chair, by the ResponsibilityNCR Committee Chair. |

| 2024 PROXY STATEMENT |  30 |

gOvERNaNCE Action Item | Board and Committee Assessment | | 360-Degree Peer and Self-Assessment | Action

Planning

| These evaluations have consistently found that the Board and its committees are operating effectively. This evaluation process has led to various refinements designed to increase Board effectiveness over the past few years, including: ► Adding additional responsibilities for the Responsibility Committee, including overseeing the Company’s ESG efforts. ► Ensuring that Board and committee agendas are appropriately focused on strategic priorities.

► Increasing focus on continuous Board succession planning and refreshment.

► Continuing to prioritize diversity when seeking new Board candidates.

► Enhancing Board evaluation process with a 360-degree peer and self-assessment facilitated by an independent third party.

► Ensuring that Board and committee agendas are appropriately focused on strategic priorities. ► Increasing focus on continuous Board succession planning and refreshment. ► Adding additional responsibilities for the NCR Committee, including overseeing ESG. ► Establishing the Technology Committee, given the Board’s increased focus on the Company’s technology and digital engagement oversight responsibilities, including the significant GTS investments included in the Lace Up Plan. ► Rotating committee and committee chair assignments periodically on a staggered basis to provide opportunities to foster diverse perspectives, develop further the depth and breadth of knowledge within the Board, and prepare the Board for future director succession. ► Recommending specific topics for directors to attend external continuing education programs to maintain their expertise and share takeaways with the other directors concerning these programs. | | These evaluations have consistently identified development opportunities for each director. They have also found that each director: ► Demonstrates a commitment to the Company’s core values. ► Participates actively and constructively in, and is well-prepared for, Board and committee meetings.

► Exercises independent judgment when considering issues before the Board and committees.

► Seeks opportunities to proactively strengthen their understanding of their role as a director and is open to ongoing training and constructive feedback.

► Participates actively and constructively in, and is well-prepared for, Board and committee meetings. ► Exercises independent judgment when considering issues before the Board and committees. ► Brings functional expertise to the Board to augment management’s thinking and development. ► Seeks opportunities to better understand the Company’s business and issues that are important to shareholders and offers innovative solutions to these challenges. | |

| 2022PROXY STATEMENT |  31

|

GOVERNANCE

STOCK OWNERSHIP GUIDELINES

The Company’s Stock Ownership Guidelines align the interests of non-employee directors and executives with the interests of shareholders, and promote the Company’s commitment to sound corporate governance. These guidelines apply to the Company’s non-employee directors, executive officers, corporate officers, and certain other executives. The participants are expected to achieve and maintain beneficial ownership of Common Stock having a value equal to at least the multiple indicated in the table below of the remuneration payable to them from time to time. The individual guidelines established for each participant are as follows:

Position | Multiple | | | Non-Employee Director | 4x | Annual Retainer Fee

(both Cash and Equity)

|  | Chief Executive Officer | 6x | Annual Base Salary Rate |  | Chief Operating Officer | 4x | Annual Base Salary Rate |  | Executive Vice President | 3x | Annual Base Salary Rate |  | Senior Vice President

Senior Vice President and General Manager

| 2x | Annual Base Salary Rate |  | Corporate Vice President

Vice President and General Manager

Select Vice Presidents

| 0.5x | Annual Base Salary Rate |  |

For purposes of calculating beneficial ownership, (i) Common Stock, RSUs, and DSUs count towards ownership, (ii) PSUs and ESPP shares count once earned and purchased, respectively, and (iii) stock options and shares held through the 401(k) Plan are disregarded.

Executives and Non-Employee Directors are required to achieve their Stock Ownership Guideline within five years of their hiring or promotion effective date that caused such employee to be covered by these guidelines, and their election to the Board, respectively. In the event of any increase in the required ownership level, either as a result of an increase in the remuneration paid or the multiple, the target date for compliance with such increased ownership guideline is five years after the effective date of such increase.

In the event any person subject to these guidelines fails to be in compliance by the applicable compliance date, they are required to hold the net shares obtained through all future stock option exercises and RSU vestings, after withholding for the payment of applicable taxes, until such person is in compliance; provided, however, that in order to take into consideration fluctuations in the Company’s stock price, any person who has been in compliance as of the end of at least one of the two preceding fiscal years and who has not subsequently sold shares will not be subject to the holding requirements.

The Responsibility Committee will consider a Non-Employee Director’s failure to comply with these guidelines when considering that director for re-election to the Board.

The Company measures compliance at the end of each fiscal year, with the compliance determination at that point in time applying for the entire ensuing fiscal year, regardless of fluctuations in the Company’s stock price.

All director nominees, the CEO, and all other executives subject to these guidelines were in compliance as of the end of the 2021 fiscal year.

POLITICAL CONTRIBUTIONS AND PUBLIC ADVOCACY Our Code of Business Conduct prohibits making contributions on behalf of the Company to political parties, PACs, political candidates, or holders of public office. The Company is a member of certain trade associations, which support their member companies by offering educational fora, public policy advocacy, networking, and advancement of issues important to the retail and footwear industries, as well as the business community generally. Given the diversity of interests, viewpoints, and broad membership represented by these trade associations, their positions may not always reflect the Company’s values. The Company is a member of, and has paid membership fees to, RILA and The Business Council, which, as part of their overall activities, may engage in advocacy activities concerning issues important to the retail or footwear industries or the business community generally, as applicable. For additional information regarding our Board’s political and public advocacy oversight, see Political and Public advocacy Oversight on page 35. | | We periodically review our membership in trade associations, and the positions they support, to evaluate whether they align with our values. If we identify a significant inconsistency on a material policy issue, we discuss and review our options with respect to such organization, including the benefits and challenges associated with our continued membership. We may take certain actions to address material misalignment, including engagement with the trade association or termination of our membership. |

31 | Foot Locker, Inc. |

gOvERNaNCE Our Code of Business Conduct prohibits making contributions on behalf of the Company to political parties, political action committees, political candidates, or holders of public office.

The Company is a member of certain trade associations, which support their member companies by offering educational forums, public policy advocacy, networking, and advancement of issues important to the retail and footwear industries, as well as the business community generally. Given the diversity of interests, viewpoints, and broad membership represented by these trade associations, the positions they take may not always reflect the Company’s positions. Also, we monitor the use of membership dues paid to trade associations for consistency with the Company’s values and business objectives.

32

| Foot Locker, Inc. | |

GOVERNANCE

The Company is a member of, and has paid membership fees to, the following organizations which, as part of their overall activities, may engage in advocacy activities with regard to issues important to the retail or footwear industries or the business community generally, as applicable:

| ► | U.S. Chamber of Commerce |

Mr. Johnson is a director of FDRA and Chairman of RILA.

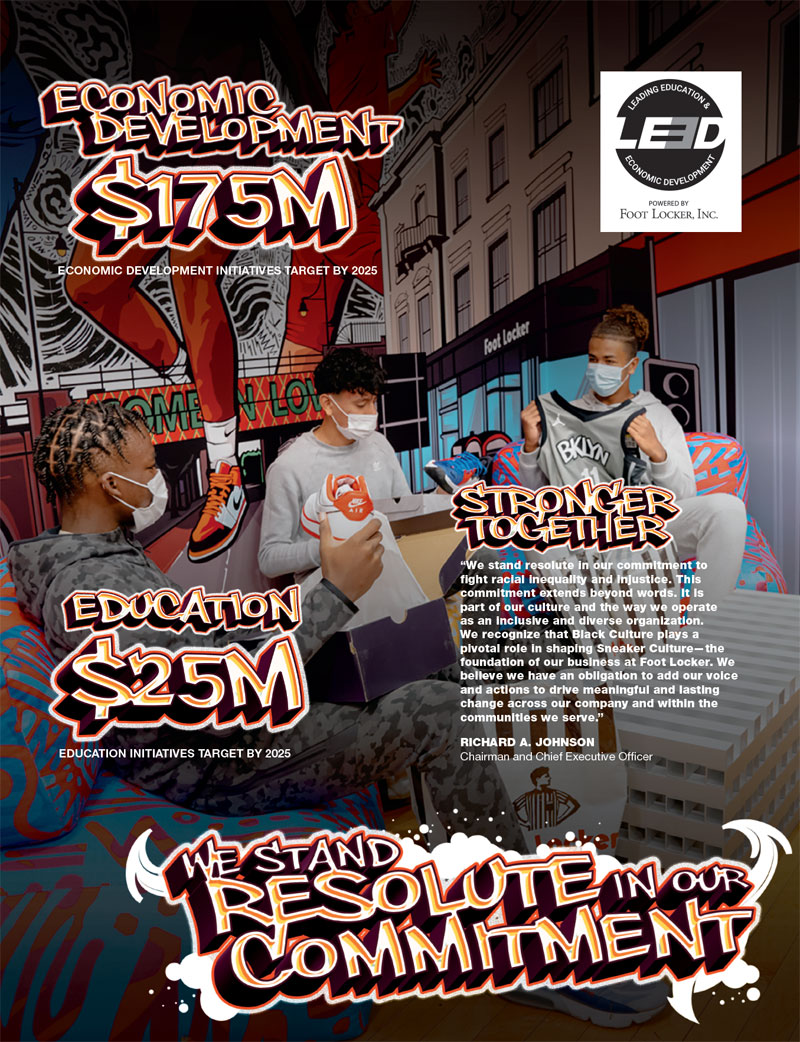

Notwithstanding these policies, we believe that our stakeholders look to us for leadership and to have a voice that is aligned with their values. As a purpose-driven organization, we have an obligation to add our voice and actions to drive meaningful and lasting change within our Company and the communities we serve.

For additional information regarding our Board’s political and public advocacy oversight, see Political and Public Advocacy Oversight on page 36.

OUR BOARD’S OVERSIGHT OF OUR BUSINESS The Board believes deeply that it must be fit for its purpose and provide strategic value to the Company. Oversight of the Company’s business strategy is a key responsibility of the Board, including work embedded in the Board committees. The Board believes that overseeing and monitoring strategy is a continuous process and takes a multilayered approach in exercising its duties. The Board’s oversight, and management’s execution of business strategy, are viewed with a long-term mindset and a focus on assessing both opportunities for, and potential risks to, the Company. In addition to financial and operational performance, other measures, including ESG goals, are discussed regularly by the Board and its committees. The Board believes deeply that it must be fit for its purpose and provide strategic value to the Company. This dynamic has been highlighted during the COVID-19 pandemic, as the Board’s focus quickly pivoted toward protecting the communities we serve, keeping our team members safe, and maintaining financial stability for our shareholders.

While the Board and its committees oversee strategic planning, management is charged with developing and executing the business strategy. Management is completely transparent with the Board. To monitor the performance of the Company’s strategic goals, the Board maintains an open dialogue with, has regular access to, and receives ongoing updates from, management. For example, our Lead Independent Director hasNon-Executive Chair engages in regular cadence of communication and engagement with management, including ongoing dialogue with the CEO and monthly calls with management,members of the executive leadership team, and each of the committee chairs regularly engages with their respective management liaisons. These discussions are enhanced with “hands-on” experiences, such as store and facilityregular visits to provide directorsour stores to engage with opportunities toour Stripers, understand the business, see strategy execution first hand.firsthand, and ultimately contribute to the oversight of our Lace Up Plan. | 2022PROXY STATEMENT |  33

|

GOVERNANCE

HUMAN CAPITAL MANAGEMENT AND SUCCESSION PLANNING OVERSIGHT The Board believes that the strength of the Company’s workforce is one of the significant contributors to our success as a global brandcompany that leads with purpose. One of the primary responsibilities of the Board is to ensure that the Company has a high-performing CEO and management team. To meet that goal, the Board, the Human CapitalHCC Committee, the ResponsibilityNCR Committee, and management share responsibility for management development and succession planning:planning, guided by a very intentional process: Responsible Party | | Oversight Area | Board | | Oversight of these topics as part of its overall oversight role, including regular reviews of management development and succession planning to maximize the pool of emerging diverse talent who can assume top management positions without undue interruption. The Board is committed to actively seeking highly-qualified diverse individuals from a range of backgrounds—in terms of gender, ethnicity, and perspectives—to include in the pool of potential candidates. | | In assessing possible CEO and other senior leadership candidates, our independent directors identify the skills, experiences, and attributes they believe are required to be an effective leader in light of the Company’s global business strategies, opportunities, and challenges. This process is designed to prepare the Company for both expected successions, such as those arising from anticipated retirements, as well as those occurring when executives leave unexpectedly, orincluding due to death, disability, or other unforeseen events. Each director has complete and open access to any member of management. Members of management, including those several levels below senior management, are invited regularly to make presentations at Board and committee meetings and meet with directors in informal settings to allow the directors to form a more complete understanding of the executives’ skills and character. We maintain updated emergency succession plans for the CEO and other executive committee members.CEO. Succession reviews for key executive roles consist of an assessment of internal candidates as well asand external talent identified by executive search firms.firms, as well as professional and leadership development plans for internal candidates. Executive search firms are expected to include in their initial lists of candidates qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin, gender, and sexual orientation. | Human Capital | | | | | | HCC Committee | | As described in its charter, primary responsibility for organizational talent and development and management succession planning, including regular reviews of executive performance, potential, and succession planning with a deeper focus than the full Board review, emphasizing career development of promising management talent. The Board made human capital management a priority through its Human CapitalHCC Committee, which oversees the Company’s strategies and initiatives on diversity and inclusion, employee well-being, compensation and benefits, program, and engagement. | Responsibility | | | | | | NCR Committee | | As described in its charter, primary responsibility for reviewing and making recommendations regarding the governance and process around CEO succession planning. The Board made ESG a priority through its Responsibility Committee, which oversees the Company’s ESG efforts, including diversity and inclusion and the LEED initiative, which serve as talent recruitment tools. | Management | | | | | | Management | | Collaboration of the Chief Human Resources Officer and senior Human Resources leaders with functional leaders across the Company in developing and implementing programs to attract, assess, and develop management-level talent for possible future senior leadership positions. |

For additional information on the Company’s human capital management strategies and initiatives, see our Annual Report, which is available at investors.footlocker-inc.com/ar. | 2024 PROXY STATEMENT |  32 |

gOvERNaNCE  34

| Foot Locker, Inc. | |

GOVERNANCE

ESG OVERSIGHT

The Board is actively engaged in the oversight of the Company’s global ESG program. In exercising its authority, the Board recognizes that the long-term interests of our shareholders are best advanced when considering other stakeholders and interested parties, including customers, team members, business partners, and the communities we serve. The Responsibility Committee oversees our global ESG program, and the Board receives updates from the Responsibility Committee Chair throughout the year. In addition, each of the Audit Committee, Finance Committee, and Human Capital Committee have certain ESG oversight responsibilities relevant to their respective committees.

| | | Inspired by engagement with our shareholders, the Company has begun publishing an annual Impact Report. The Impact Report provides details on our global ESG program, consistent with the SASB reporting standards and TCFD reporting framework. Our global ESG program is focused on:

|  |  | | | For additional information regarding our global ESG program and Board oversight, see ESG on page 96, ESG Oversight on page 35, and our Impact Report, which is available at investors.footlocker-inc.com/impactreport. | | |

The Company has adopted the following policy statements related to its global ESG program:

Policy Statement | Purpose | Global Environmental and Climate Change Statement | Sets out certain sustainability and environmental commitments and priorities, including reducing GHG emissions that have an adverse effect on climate change, and certain responsibilities of its suppliers. This policy statement is available at investors.footlocker-inc.com/climate. | Global Human Rights Statement | Sets out certain commitments, including maintaining a work environment that respects and supports the provision of basic human rights to all of its team members around the world, regardless of the country in which they work, to the full extent permitted by law, and certain responsibilities of its suppliers. This policy statement is available at investors.footlocker-inc.com/humanrights. | Global Occupational Health and Safety Statement | Sets out certain commitments, including operating in a safe and responsible manner to protect the health and safety of its team members, partners, and customers, and certain responsibilities of its suppliers. This policy statement is available at investors.footlocker-inc.com/safety. | Global Water Stewardship Statement | Sets out certain commitments, including operating in a safe and responsible manner to protect against water risks and seeking to promote the human right to water and sanitation, and certain responsibilities of its suppliers. This policy statement is available at investors.footlocker-inc.com/water. |

| 2022 Proxy Statement |  35

|

GOVERNANCE

POLITICAL AND PUBLIC ADVOCACY OVERSIGHT

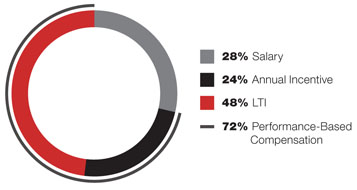

Our Board has political and public advocacy oversight responsibility, including ensuring that management’s political and lobbying expenditures are aligned with the Company’s strategy. The Board has adopted policies and procedures to oversee political and lobbying expenditures. As part of its ESG oversight responsibility, the Responsibility Committee reviews annually the Board’s policies and procedures regarding politics and public advocacy and that the Company’s publicly-stated positions are aligned with its related activities and spending. For additional information regarding our policies concerning political contributions and public advocacy, see Political Contributions and Public Advocacy beginning on page 32.